Page Contents

Beyond WiFi: The Shift Towards Cellular Connectivity in POS Systems

Page Contents

Point of Sale (POS) terminals are the bread and butter of any retailer. The evolution of digital solutions has meant that retailers are no longer limited to using a physical terminal alone and can turn any mobile device into a POS (mPOS) terminal.

The benefits are manyfold. An mPOS eradicates the customer queue as any employee can become a mobile checkout point. It’s also much easier to use as vendors don’t have to buy separate equipment and can use the devices they already have.

Whatever type of POS terminal you use, though, you need connectivity in order to take payments. The type of connectivity you use, WiFi or cellular, can make all the difference in how reliable and secure your checkout process is.

The POS Ecosystem

First, let’s take a look at all the players involved in the POS value chain:

- Terminal Vendors: these are the manufacturers of the physical devices and include global players such as PAX Technology, Qualcomm, Verifone and others. White-labelled options are also available for vendors who want to add the POS device to their branded solution.

- Distributors – these are the suppliers who hold the inventory of POS devices, provide shipping, merchant supplies fulfilment terminal repair services and overall support and troubleshooting.

- Independent Service Operators (ISOs) – these can be local or global operators that support businesses in payment processing by partnering with a financial institution, such as a bank or a larger payment processor. They can also provide the physical POS terminals, the payment software as well as any tech support the business may need.

- Retailers – the retailers are the final consumers at the value chain who get to use the POS terminals for running their own business. This can be anything from global retail chains to local stores.

The Complex World of POS Compliance

POS terminals, whether electronic or physical, handle incredibly sensitive data. This means that they need to be compliant with a number of rules and regulations that stipulate how payment and customer data is captured, processed and stored.

Depending on where your business operates, you’ll need to comply with different data protection laws and regulations. Some, like GDPR and PCI-DSS, are more widely applicable while others such as CCPA and UCPA are US-specific.

In the US, and some other countries, vendors also need to obtain a PTCRB certification which ensures that devices that operate on North American networks, like AT&T, Verizon or T-Mobile, are fully compliant with network requirements. This means that any vendor who wants to use SIM cards from multiple operators would need to obtain certification from each operator individually. Not only is this incredibly costly and complicated, but it can also take a long time to achieve.

Aside from having a compliant data processing system, you also need to consider possible device and network vulnerabilities which can lead to unauthorized data use.

WiFi vs. Cellular Connectivity

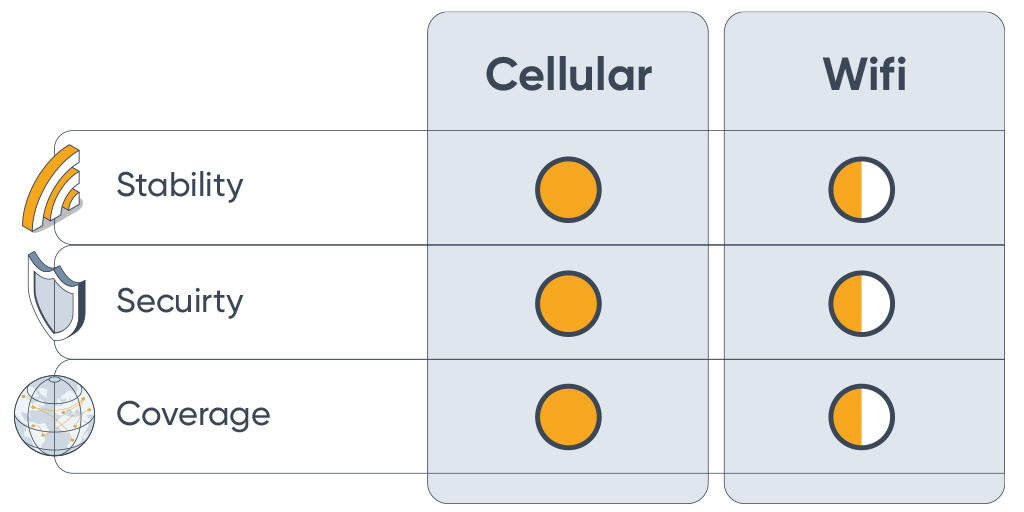

Stable connectivity is paramount when it comes to processing payments. While most POS devices have relied on WiFi connectivity in the past, many retailers today opt for global cellular connectivity instead.

That’s because WiFi is more prone to the following issues:

- Connectivity: move your terminal to a more remote area of your store and suddenly you can’t take payments. The same applies if you operate in areas where the WiFi signal is generally poor or if too many people connect to the same network at the same time.

- Security: this can be a serious threat if you use an unsecured WiFi network as your data isn’t encrypted and gets exposed to external threats. Even secured WiFi networks are less secure than relying on 4G or 5G connectivity.

- Stability: all it takes to lose connectivity is for someone to change your WiFi password, making the WiFi signal rather easy to interfere with. Sometimes, the signal itself can drop, which exposes you to unnecessary downtime in processing payments.

Cellular networks, on the other hand, are far more reliable and secure. However, there are some things you need to consider when using it internationally:

- Multiple providers: If you want reliable and seamless connectivity across your whole business, it’s very likely that you’ll need contracts with several network providers. This can be not only costly, but very difficult to manage as you have to navigate different contracts, regulations and data packages.

- Roaming constraints: roaming can be a true challenge when relying on a single network for your POS terminals. Not only is roaming far more expensive, but it can often lead to poor experience due to high latency. Your data is also less safe as it leaves your home country and is processed in another country where you may not have insights into how it’s being used.

- Expensive plans: instead of charging you only for active devices and the actual data you use, most mobile operators or IoT MVNOs start charging you from the moment they ship you the SIM card or give you a grace for a number of months.They also charge your for your full data plan regardless of how much data you’ve actually used.

Fortunately, there’s a simple solution to this.

A New Approach to Connectivity

Managing individual partnerships with mobile operators across countries is not a sustainable way of running a business. In fact, modern IoT connectivity solutions rely on intelligent cellular systems which are able to provide global connectivity at local rates using a single SIM card.

At floLIVE, for instance, customers can use a single Multi-IMSI SIM card to connect to multiple carriers across different countries without the need to physically replace their SIM cards. Over-the-air (OTA) provisioning means they can manage and troubleshoot each SIM remotely, making the management of the overall IoT solution that much easier.

Another big issue with connectivity is downtime which 98% of retailers say it costs them $100,000 per hour. When using a Multi-IMSI SIM Card that relies on autonomous switching to automatically connect to the most optimal network provider depending on the location, you risk zero downtime. Here, you can decide to use your cellular connectivity as the primary source or as a back-up should you rely mostly on WiFi to process payments.

Depending on the size of your operations, cost can also become a major concern as you’re locked into expensive plans. We’re very much aware of this limitation of traditional connectivity plans which is why our customers only pay for the devices and data they use. So, if you have devices that still haven’t been deployed they won’t figure in your expenses. Likewise, if you’re using cellular connectivity only as a back-up, you probably won’t pay much in data usage either. The goal here is to really give businesses full control over their connectivity solution and allow them the flexibility to customise it as they see fit.

Opportunity to Scale

A quality IoT connectivity solution won’t just simplify your network access, but it will also allow you to retain full visibility over your device performance and data consumption. At floLIVE, customers have access to a centralised connectivity management platform (CMP) that comes with a real-time monitoring and alerting system. This keeps you up-to-date on potential security vulnerabilities and notifies you if a device malfunctions.

Going beyond this, the CMP supports the launch of child accounts which gives customers the flexibility to hand over control to regional distributors or directly to clients who may want to manage their own solution—opening up a whole new world of business opportunities and monetisation routes. Not only does this make them more agile and adaptable themselves, but it also gives them the edge as a service provider.

Are you ready to upgrade your connectivity solution and see your business grow? Schedule a call to speak to one of our connectivity advisors.

Join Our Newsletter

Get the latest tips and insights in our monthly newsletter.